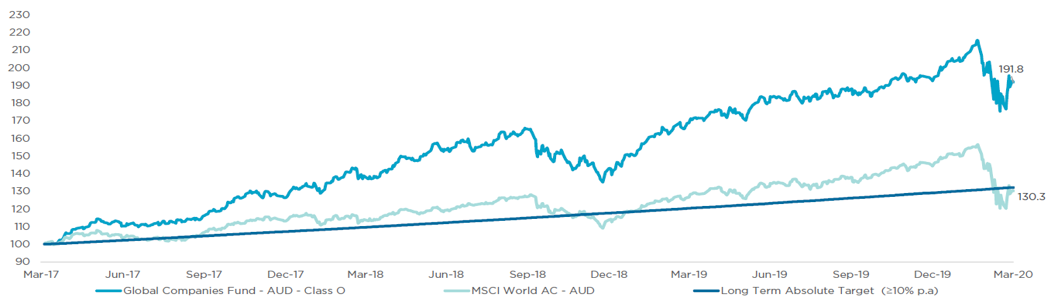

AMP Capital marks the three-year anniversary of the Global Companies Fund, its global equities Australian Unit Trust fund. The Fund’s Australian institutional offering has achieved an absolute return over the first three years to 31 March 2020 of 91.8% net of fees[1], compared to global equity market returns of 30.3% over the same period[2]. On an annualised basis the Fund has returned 24.2% per annum net of fees[3], versus the market returning 9.2%.[4]

The three-year track record is a key milestone for the fund and coincides with total assets in the capability (available via an Australian Unit Trust, New Zealand PIE and UCITS structure) reaching almost AUD400 million.[5]

AMP Capital, a global investment manager with AU$203 billion in assets under management[6], established a London-headquartered global equity capability in June 2016 and launched the Global Companies Fund, its first global equities product, in March 2017.

The Fund aims to deliver a compound rate of return greater than 10% per annum, after fees and costs, over the long term, with a lower risk of capital loss relative to broader global equity markets.

Over the past three years, culminating in the Covid-19 events, the strategy has generated higher than market returns during the bull market whilst also protecting clients’ assets during the recent dramatic downturn consistent with the dual objectives of the strategy. Since inception the strategy has in total outperformed positive monthly market returns by 82% and negative monthly market returns by 14%.[7]

The Fund’s investment approach is long term, absolute risk (not benchmark) aware, concentrated, and offers investors full portfolio and process transparency. The long-only fund is managed collaboratively by the team of four Citywire AAA-rated[8] investment managers located in London, Sydney and Hong Kong, led by Simon Steele, AMP Capital’s London-based Head of Global Equities.

NB: Past performance is not an indicator of future returns.

Chart as at 31 March 2020. Total returns are calculated using the net asset value per unit for the relevant month end for the Fund’s Australian institutional offering. This price may differ from the actual unit price for an investor buying or selling an investment. Actual unit prices will be confirmed following any transaction by an investor. Returns shown are after (net) the deduction of fees, are before tax and assume all distributions are reinvested.

Simon Steele, Head of Global Equities at AMP Capital, commented, “When we developed this strategy, we wanted to challenge some of the ‘norms’ of equity investing, with a focus on client outcomes. Our mandate was to deliver a global equity product that focussed on delivering repeatable and highly attractive long-term risk-adjusted returns for our clients, and we only invest in companies that can demonstrably support that objective.

“We set ourselves a target to achieve annualised double-digit returns after fees through a full market cycle, a goal that has been realised as we mark the three-year anniversary of the fund. Only companies that we expect to maintain exceptional profitability over the long term and generate stable but superior growth in cash flows, year in year out, have earned a place in our portfolio. Over the past three years we have dismissed around 200 high-quality companies that might otherwise be seen as attractive investment opportunities.

“Many teams talk about collaboration – for us it is a core belief as to how we deliver the best outcomes for our clients. We invest substantial effort to ensure ongoing close collaboration and no stock enters our portfolio without the explicit support of all four of our Investment Managers (Andy Gardner, David Naughtin, Neil Mitchell and myself).

“Notwithstanding the current crisis and its deeply painful near-term human and economic consequences, we remain clearly focused on our objective and continue to identify companies that we believe are exceptionally well placed to take meaningful economic share in the years ahead.”

The Fund invests in a portfolio of 25 to 35 companies, selected for their strong wealth creation credentials through a rigorous and collaborative absolute risk aware investment process. The team believe that superior long term-wealth creation (the ability to compound cashflows at an above average rate persistently) sits at the core of a successful equity investment.

According to Simon Steele, “Wealth creation is characterised by strong competitive advantage, disciplined capital allocation and long-term structural pathways to growth, and we demand that all three pillars of success are in place before committing client capital to a long-term investment.”

About AMP Capital

AMP Capital is a global investment manager with A$203 billion in assets under management as of 31 December 2019 and more than 250 investment professionals. AMP Capital has a heritage and strength in real estate and infrastructure, and experience in fixed income, equities and multi-asset solutions. Its majority shareholder is AMP Limited, which was established in 1849, and is one of Australia's largest retail and corporate pension providers. AMP Capital has a strategic alliance with Mitsubishi UFJ Trust and Banking Corporation, which is also a shareholder.

[1] Net returns are net of all fees and costs and reflect the reinvestment of dividends and other income. Source: AMP Capital. For details on the Fund’s platform and retail offering performance, which is over a shorter time horizon, please go to ampcapital.com. Past performance is not a reliable indicator of future performance.

[2] MSCI World All Countries Index (AUD). Source: Factset

[3] Per footnote 1

[4] Per footnote 2

[6] AUM as at 31 December 2019. Source: AMP Capital

[7] Based on AMP Capital Global Companies Strategy Composite (Gross) USD comprising AMP Capital’s AUD, USD hedged / unhedged and NZD versions of the strategy and MSCI World All Countries Index (USD). Source: AMP Capital

[8] Source: Citywire, May 2020

Important note

AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMPCFM) is the responsible entity of and issuer of units the Fund. To invest investors will need to obtain the current Product Disclosure Statement (PDS) from AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232 497) (AMP Capital). The PDS contains important information about the Fund and should be considered before making a decision about whether to acquire, hold or dispose of units in the Fund. Neither AMP Capital, AMPCFM nor any other company in the AMP Group guarantees the repayment of capital or the performance of any product or any particular rate of return referred to in this document. Past performance is not a reliable indicator of future performance. While every care has been taken in the preparation of this document, AMP Capital makes no representation or warranty as to the accuracy or completeness of any statement in it including without limitation, any forecasts. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. Investors should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to their objectives, financial situation and needs.