AMP has launched Australia’s first fully integrated ‘whole of wealth’ mobile app to drive customer engagement with their finances – as Newspoll research shows a quarter of working Australians know little or nothing about their superannuation investments.

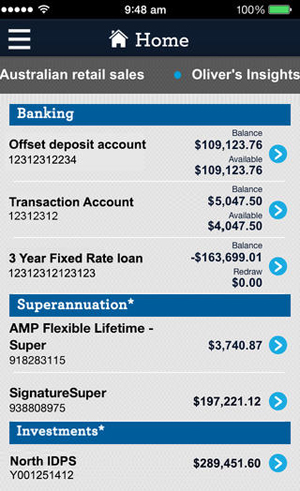

The AMP.Own Tomorrow app is the first in Australia where customers can access their banking, superannuation, insurance and investments, including access to AMP’s leading North platform and non-AMP investments and direct shares.

Key features include:

- A complete position of your finances across banking, superannuation, insurance and investments, including a customer’s non-AMP investments

- SMS notifications when your AMP Bank account balance is low, for deposits and withdrawals over certain thresholds, and alerts for super contributions

- A detailed view of your insurance inside and outside superannuation

- BPAY, ATM locator, internal and external bank transfers and ability to consolidate super accounts

- Regularly updated news and insights articles on retail and investment trends

- Enhanced security features

AMP Chief Customer Officer Paul Sainsbury said people engaged with their banking and superannuation were more likely to be in a better position to enjoy a comfortable retirement.

“We know that people engaged with their superannuation are more likely to achieve their retirement goals so it’s never too soon for people to increase their understanding of their superannuation choices, and their finances in general,” Mr Sainsbury said.

“One of the ways the AMP app helps customers be more engaged is that it enables customers to choose to be notified when they and their employer pays money in their superannuation account.

“As an industry we have to make it easy for customers to keep on top of how their retirement savings are tracking. The AMP app does that by combining all of a customer’s banking, superannuation, investment and insurance arrangements into one,” Mr Sainsbury added.

The Newspoll and AMP research shows 26 per cent of respondents either did not know how their super was invested or knew nothing about super at all.

The research showed that people nearing retirement have the highest engagement with their super with 53 per cent of 50-64 year olds making investment decisions about how their superannuation is invested followed by 25-34 year olds at 52 per cent and 35-49 year olds at 49 per cent.

The AMP/Newspoll also found:

- Overall, 44 per cent of people said they decided how their super was invested while 34 per cent left this decision to their super fund.

- 15 per cent of those surveyed thought the decision on how their super was invested was made by someone else such as the government, family member, financial adviser, employer or partner.

- New South Wales was the most engaged state at 54 per cent while Western Australia was the least engaged at 40 per cent.

The research, to gauge Australians level of engagement with their superannuation, conducted by Newspoll, surveyed online around 1200 people aged 18-64.

The AMP .Own tomorrow app is now available to Apple users via the Apple store and android users via Google Play.

See inside the new AMP mobile app (video guide)