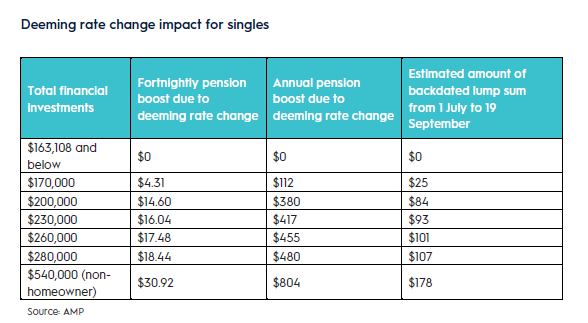

AMP research has found part-pensioners could receive a lump sum payment of up to $178 for singles and $234 for couples when the federal government’s deeming rate changes come into effect next month.

The deeming cut is the first since 2015 and was announced earlier this year. It will be backdated to 1 July meaning eligible part-pensioners will receive a backdated payment on 19 September 2019.

The deeming cut will coincide with a scheduled increase to the age pension – yet to be announced by the government – giving pensioners a double pay rise.

AMP Technical Strategy Manager John Perri said: “Pensioners will have two reasons to smile in September with the scheduled increase to the pension coinciding with the deeming rate cuts. Although the changes for the vast majority of pensioners are relatively small, having some extra money in their budgets to tackle cost-of-living expenses is a positive thing.

“The pension is means tested and looks at a single or couples’ level of financial investments, income and assets, to determine how much they receive each fortnight.

“Having a good understanding of how many investments and other assets you can hold before your pension is impacted and by how much is a key tool to help plan for retirement.”

The higher deeming rate is being reduced by 25 basis points to 3.00 per cent for singles with financial investments over $51,200 and couples with financial investments over $86,200. The lower deeming rate is reducing by 75 basis points to 1.00 per cent for financial investments under these thresholds.

Mr Perri added: “Deeming rules are used to assess income from financial investments for social security purposes. Deeming assumes that financial investments are earning a set rate of income, regardless of the amount they are actually earning. Deeming applies to most financial investments, not just saving and term deposit accounts, including listed and unlisted shares, insurance bonds and many more.”

Deemed income is added to a recipient's social security assessable income from all other sources and the total is then used to calculate the rate of social security entitlement under the income test.

Deeming thresholds are indexed annually on 1 July. If required, changes to the deeming rates are usually made in March or September although rates can be changed at other times during the year if the returns in the financial market fluctuate significantly. Prior to this change, the previous change to deeming rates occurred on 20 March 2015.

Calculation assumptions: Age pension rates and thresholds as at 1 July 2019. Based on deeming rates reducing to 1.00% and 3.00%. Deeming thresholds remain the same. Table only shows financial investments (bank, shares, managed funds, super accumulation after age pension age), and assumes person has no other assets/income. The lump sum backdated payments relate to the period from 1 July 2019 to 19 September 2019. The indexed age pension rate applies from 20 September 2019.