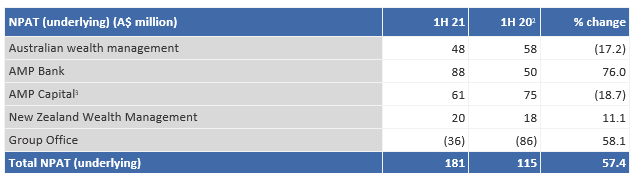

1H 21 results

- Improved 1H 21 performance, with recovery in economic and market conditions, and transformation strategy delivery driving 57 per cent increase in underlying earnings.

- NPAT (underlying)[1] of A$181 million (1H 20: A$115 million) reflecting higher investment income, a strong cost performance and increased earnings in AMP Bank, which benefited from the release of credit loss provisions; 1H 21 NPAT (statutory) of A$146 million (1H 20: A$203 million).

- Customer remediation file reviews complete; program fully provisioned with payments to customers accelerating in Q3 21.

- Investment income of A$57 million, predominantly from Group Office, reflects an increase of A$48 million on 1H 20, driven by improved returns on the group’s cash investments, growth in China Life Pension Company (CLPC) earnings, including first cash dividend, and contributions from Resolution Life Australasia.

- Strong capital position maintained through transformation program; A$452 million surplus capital (above target capital level).

- Board to maintain conservative approach to capital management and dividend until requirements for the demerger and future strategies are finalised; has resolved to not declare an interim 2021 dividend.

- Demerger planning on track: sale of Global Equities and Fixed Income (GEFI) business agreed and Multi-Asset Group (MAG) transfer underway; internal operational separation targeted by FY 21; demerger to complete in 1H 22.

- Significant step forward in Advice re-shape with implementation of new service model for aligned advice and conclusion of Buyer of Last Resort arrangements from the end of 2021.

- Cost reduction delivering to targets; A$169 million cumulative savings delivered since FY 19; on-track to deliver A$300 million of annual run-rate cost savings by FY 22 timeframe.

[1] Net profit after tax (underlying) represents shareholder attributable net profit or loss after tax excluding non-recurring revenue and expenses. NPAT (underlying) is AMP’s preferred measure of profitability as it best reflects the underlying performance of AMP’s business units.

AMP Chief Executive Alexis George said:

“I’m pleased to have joined AMP at this important time, where helping our customers to invest and plan for the future has never been more important.

“Our business has had a stronger first half financially, we have demonstrated our commitment to deliver our strategic priorities of reshaping and simplifying the business and focusing AMP Capital on private markets.

“We are starting to see some positive signs of growth and innovation, particularly in our bank and platforms businesses where we are introducing new services that our clients want.

“Our teams in AMP Capital have stood strong for clients during a period of change. We have continued to fund raise in infrastructure debt and to deploy capital and realise returns on assets for clients in infrastructure equity and real estate.

“Getting our demerger done will be a core priority. We’ve set out a clear timeline to establish and separate the AMP Capital Private Markets business this year, and complete the demerger in 1H 22.

“We’ll also focus on rebuilding our brand and culture, and restoring trust and pride among our customers, employees and shareholders. I am personally committed to building an inclusive, accountable and high- performing culture within both our businesses.

“I want to thank and applaud all of our people for managing the disruption, both professionally and personally, being caused by the pandemic. We play an important role in supporting customers through challenges of lockdowns and the uncertainty they are experiencing. As an organisation, we also have a responsibility to support our people and their families in getting vaccinated, and in providing the flexibility to do this.

“Significant steps have already been taken to transform AMP and I’m very excited about the opportunities that exist for our business, as we drive our demerger and set up both businesses for a successful future.”

Business unit results

AMP Australia

Australian wealth management

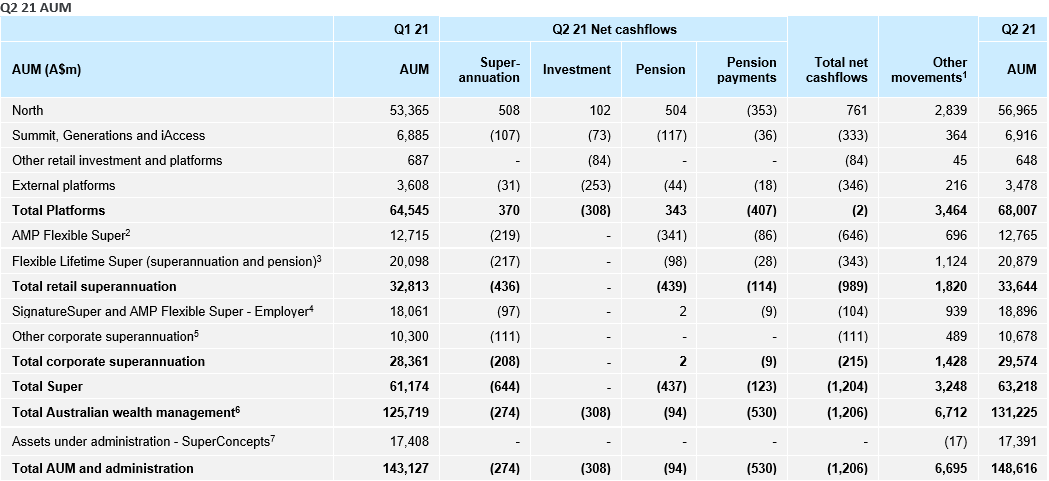

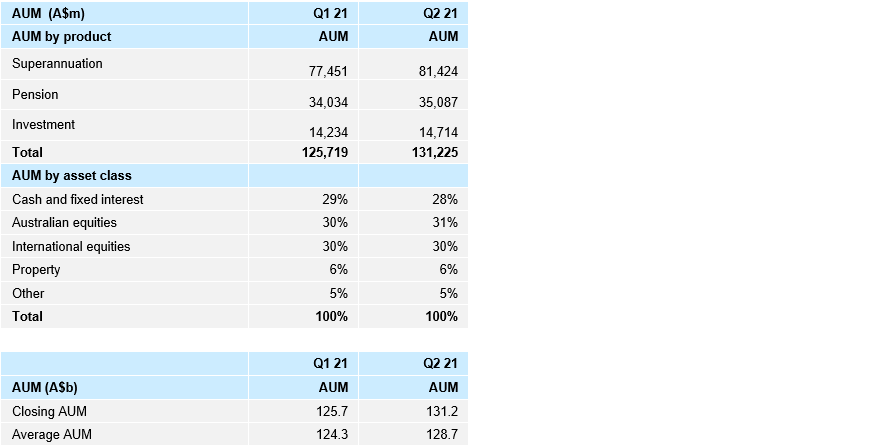

Australian wealth management increased its assets under management (AUM) in 1H 21, though earnings were impacted by pricing and legislative changes.

AUM of A$131.2 billion at 1H 21 increased 6 per cent from FY 20 A$124.1 billion, driven by strong investment markets.

[2] 1H 20 NPAT (underlying) has been restated to reflect the removal of market adjustment to investment income.

[3] AMP Capital is shown net of minority interests in 1H 20. AMP regained 100 per cent ownership of AMP Capital and MUTB’s minority interest consequently ceased on 1 September 2020.

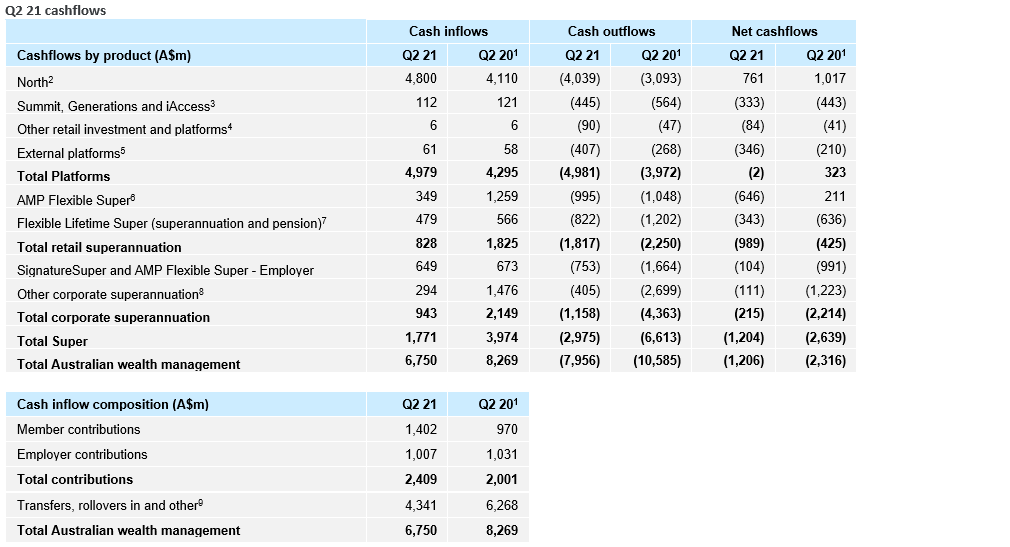

Net cash outflows of A$2.7 billion in 1H 21 improved from A$4.0 billion net cash outflows in 1H 20[4]. Cash outflows include A$1.0 billion in regular pension payments to clients in retirement.

The North platform continued to perform favourably with 1H 21 net cashflows of A$1.4 billion (1H 20: A$2.0 billion) and AUM up 10 per cent to A$57.0 billion from A$51.6 billion at FY 20. This follows a reduction in fees and ongoing expansion of managed portfolio offers.

Advice reshape nears completion creating a more productive, professional and compliant network and commencing the move to a new contemporary advice service model.

Net profit after tax (NPAT) of A$48 million (1H 20: A$58 million), reflects the impact of pricing, legislative changes and advice practice impairments, partially offset by lower variable and controllable costs from cost reduction initiatives.

AMP Bank

AMP Bank experienced strong earnings recovery led by improved macro-economic outlook and more stable funding environment.

1H 21 net profit after tax increased A$38 million (76 per cent) to A$88 million (1H 20: A$50 million), in part due to a A$12 million release of credit loss provision taken in response to COVID-19.

Return on capital in 1H 21 was 15.8 per cent, an increase of 6.7 percentage points from 1H 20, as a result of the higher profit.

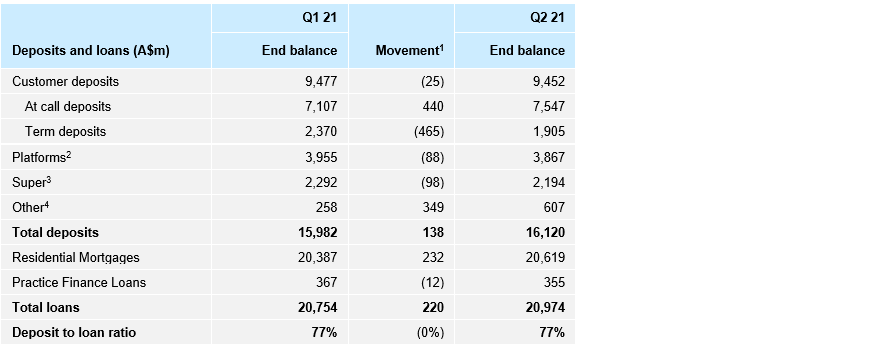

Residential mortgage book grew A$431 million to A$20.6 billion, (4.3% annualised growth) from FY 20 in a highly competitive lending environment. Total deposits at 1H 21 were broadly stable, increasing A$10 million (0.1 per cent) from FY 20, in line with strategy to optimise funding mix.

Net interest margin of 1.71 per cent in 1H 21, 8 basis points higher than 1H 20, driven by lower funding and deposit costs.

AMP Bank remains one of the lowest cost banking platforms, with a cost to income ratio of 31.7 per cent.

Credit quality was maintained with 90+ days arrears at 0.72 per cent (FY 20: 0.62 per cent), and compares favourably with peers.

AMP Bank’s initial COVID-19 home loan repayment pause program has completed. Customers experiencing financial difficulty can access assistance through the bank’s ongoing hardship support.

AMP Capital

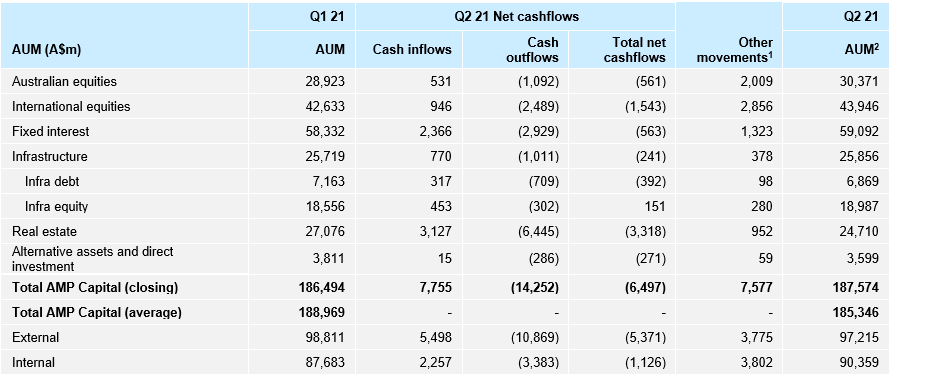

AMP Capital earnings impacted by challenging conditions and lower transaction and performance fees.

NPAT decreased to A$61 million (1H 20: A$75 million)[5] primarily from the absence of performance and transaction fees, which vary period to period. AUM-based earnings were aided by positive markets, although fell 4 per cent to A$275 million (1H 20: A$287 million); average AUM decreased 3.4 per cent to A$187.2 billion (FY 20: A$193.8 billion).

[4] Prior period cashflows have been restated to exclude products no longer reported from November 2020, following legislative changes to grandfathered conflicted remuneration, with Australian wealth management no longer earning fees on these products.

[5] The AMP Capital business unit results are shown net of minority interests. AMP regained 100% ownership of AMP Capital and MUTB’s minority interest consequently ceased on 1 September 2020.

Continued momentum in infrastructure debt and infrastructure equity series of funds with A$1.0 billion of capital deployed in 1H 21 and strong realised returns for infrastructure equity clients from successful asset divestments.

AMP Capital completed the redevelopment of the Marrickville Metro shopping centre in 1H 21 and recently opened the first phase of the Karrinyup shopping centre development. AMP Capital Wholesale Office Fund (AWOF) continued to deliver strong investment performance over the half.

External AUM decreased during 1H 21 to A$97.2 billion, largely reflecting the exit of the AMP Capital Diversified Property Fund (ADPF). External net cash outflows were A$6.7 billion, including this one-off event.

New Zealand Wealth Management

New Zealand Wealth Management (NZWM) achieved earnings growth with 1H 21 NPAT of A$20 million, an increase of A$2 million (1H 20: A$18 million), reflecting stronger investment markets and tight cost control, offsetting the impact of margin compression from product repricing.

AUM increased to A$12.6 billion in 1H 21, up A$1.0 billion (8 per cent) from 1H 20, predominantly driven by investment market gains.

Controllable costs decreased 11 per cent to A$17 million (1H 20: A$19 million), reflecting the continuous simplification and transformation of the New Zealand business.

Maintained leading position in corporate super with 42.4 per cent share of market; continued growth in non-default KiwiSaver despite loss of default status.

In 1H 21 NZWM implemented a new investment management approach which will deliver greater value to customers and demonstrates commitment to sustainable investments.

Capital position and dividend

AMP remains well-capitalised with surplus capital of A$452 million above target capital requirements, as at 30 June 2021, down from A$521 million at 31 December 2020.

The previously announced on-market share buy-back of up to A$200 million is now complete, concluding on 30 June 2021, with the deployment of A$196 million of capital to repurchase and cancel 170.5 million shares.

AMP intends to operate a small shareholding sale facility in 2H 21 to assist eligible shareholders sell parcels of shares that are less than A$500 in value.

The board continues to maintain a conservative approach to capital management to support the transformation of the business. In line with this approach, the board has resolved to not declare an interim 2021 dividend. The capital management strategy and payment of dividends will be reviewed following the completion of the demerger in 1H 22.

Demerger update

AMP announced the conclusion of its portfolio review on 23 April 2021 with the decision to pursue a demerger of AMP Capital’s private markets businesses of infrastructure equity, infrastructure debt and real estate (Private Markets).

The proposed demerger of Private Markets aims to create a more focused business, better equipped to pursue growth opportunities in its existing real assets capabilities and expand into new adjacencies.

Strong progress has been made to allow Private Markets to run as an independent business, led by its own CEO and Board with a clear go-forward strategy. In June 2021, internationally respected asset management executive, Shawn Johnson, joined as AMP Capital CEO to set its international growth strategy and lead its demerger.

A number of workstreams have been established to deliver internal operational separation by FY 21, with demerger and ASX listing to occur in 1H 22, following shareholder approval.

Director remuneration

As foreshadowed in AMP’s 2020 remuneration report, the AMP Limited Board reviewed fees for the Chair and non-executive directors following the completion of the group’s portfolio review. The Board has approved a 15 per cent reduction in Board and Committee fees, effective 1 August 2021. The Board will review fees again following the completion of the demerger.

Client remediation

AMP confirms it has completed all file reviews for its client remediation program. The total cost of the program will be A$823 million, of which approximately A$596 million represents payments to customers. This total program cost is within 6 per cent of original estimates (of A$778 million) made three years ago. These costs are now fully provisioned.

To date A$35 million has been paid to customers under the inappropriate advice program, with a further A$5 million offered, but not yet paid. Customers have so far received A$175 million in remediation under the fee for no service program, with payments accelerating in Q3 21 and expected to be largely completed by early Q4 2021.

Culture

AMP has continued to drive an organisation-wide program of initiatives to build an inclusive, accountable and high-performance culture.

Inclusion and diversity focus has been strengthened with AMP meeting the 40:40:20 gender diversity target at board and across the broader workforce, with work continuing at senior management level. An inclusion index, measured against global benchmarks, has been introduced to track ongoing progress.

Reporting on conduct and culture matters has been enhanced both internally and via the 2021 Sustainability report.

More detailed information on the 1H 21 result is available in the 1H 21 Investor report and presentation, both accessible at amp.com.au/shares.

Authorised for release by the AMP Limited Board.

Q2 21 Cashflows

Australian wealth management

1 Q2 20 inflows and outflows have been restated to reflect the treatment of insurance premiums to AMP Life, no impact to total cashflow. Other retail investment and platforms and external platforms restated to reflect impact of no longer reporting certain products following changes to grandfathered legislation.

2 North is an award-winning fully functioning wrap platform which includes guaranteed and non-guaranteed options. Includes North and MyNorth platforms.

3 Summit and Generations are owned and developed platforms. iAccess is ipac’s badge on Summit.

4 Other retail investment and platforms includes AMP Personalised Portfolio.

5 External platforms comprise AMP administered, Asgard manufactured platform products.

6 AMP Flexible Super is a flexible all in one superannuation and retirement account for individual retail business.

7 Flexible Lifetime Super (superannuation and pension) was closed to new business from 1 July 2010. A small component of corporate superannuation schemes are included.

8 Other corporate superannuation comprises CustomSuper, SuperLeader and Business Super. Business Super was closed in May 2020 with members migrated to CustomSuper or AMP Flexible Super.

9 Transfers, rollovers in and other includes the transfer of accumulated member balances into AMP from both internal (eg retail superannuation to allocated pension/annuities) and external products.

1 Other movements include fees, investment returns, distributions, taxes and foreign exchange movements.

2 AMP Flexible Super includes A$1.0b in MySuper (Q1 21 A$0.9b).

3 Flexible Lifetime Super (superannuation and pension) includes A$5.8b in MySuper (Q1 21 A$5.5b).

4 SignatureSuper and AMP Flexible Super – Employer includes A$10.3b in MySuper (Q1 21 A$9.8b).

5 Other corporate superannuation includes A$5.7b in MySuper (Q1 21 A$5.4b).

6 At Q2 21, 79% of AUM is ultimately externally managed, while 21% is internally managed.

7 SuperConcepts assets under administration includes AMP SMSF, Multiport, Cavendish, SuperIQ, Moore Stephens Annual, JustSuper, Ascend and SuperConcepts platforms, but does not include Multiport Annual, SuperConcepts Accountants Outsource, SMSF Managers and MORE Superannuation.

AMP Capital

1 Other movements include fees, investment returns, distributions, taxes, and foreign exchange movements. Includes FUM no longer consolidated upon sale of a business or fund.

2 AUM is invested capital. Committed real asset capital is excluded from AUM.

AMP Bank

1 Represents movements in AMP Bank’s deposits, loan books and deposit to loan ratio.

2 At 30 Jun 2021, Platforms include North (A$3.2b) and platform deposits (A$0.7b).

3 At 30 Jun 2021, Super deposits include AMP Supercash (A$1.8b) and Super TDs (A$0.4b).

4 Other deposits includes internal deposits, wholesale deposits and other deposits.

New Zealand wealth management

1 Other includes superannuation, retail investment platform and legacy products.

2 Other movements include fees, investment returns, distributions, taxes, as well as foreign currency movements on New Zealand AUM.