FY 20 results

- Increasing momentum on delivery of AMP’s three-year transformation strategy, amid challenging market conditions in each business unit in FY 20.

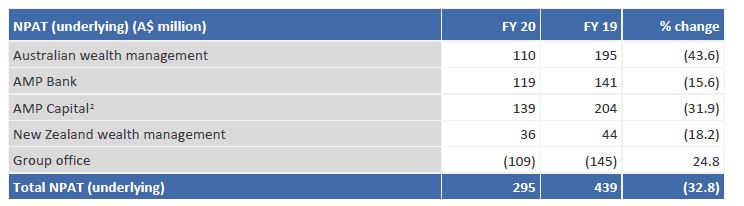

- FY 20 NPAT (underlying)1 of A$295 million (FY 19: A$439 million) reflecting the impacts of COVID-19 on our clients, our business and the broader economy and financial markets. FY 20 statutory NPAT of A$177 million, reversing A$2.5 billion loss in FY 19.

- Assets under management (AUM) in Australian wealth management (down 8 per cent) and AMP Capital (down 7 per cent), reflecting volatile investment markets and net cash outflows, which included the Australian Government’s early release of super program (A$1.8 billion).

- Resilient performance in AMP Bank which maintained its position with A$20.2 billion residential mortgage book in a competitive lending market; maintained credit quality while supporting 11 per cent of our mortgage clients with home loan repayment pauses.

- Strong capital position maintained with surplus capital of A$521 million at 31 December 2020.

- As guided, the AMP Board has resolved not to declare a final dividend for FY 20, following A$344 million paid to shareholders in the form of a 10c per share special dividend at 1H 20. The board is committed to restarting the group’s capital management initiatives including the payment of dividends, share buyback and other capital initiatives in 2021. This is subject to the completion of the portfolio review, market conditions and business performance.

- Client remediation program is now 80 per cent complete and on schedule to fully complete in mid-2021.

Portfolio review

- AMP Limited today provides the following update on its portfolio review and engagement with Ares Management Corporation (“Ares”).

- Following detailed discussions, AMP has been advised last night by Ares that it does not intend to proceed with its non-binding indicative proposal for 100 per cent of AMP of $1.85 per share. AMP continues to engage constructively with Ares in relation to AMP Capital as part of the portfolio review.

– The review has confirmed AMP’s transformation strategy for the AMP Australia (Australian wealth management and AMP Bank) and New Zealand wealth management businesses is likely to be the optimal outcome for shareholders. The AMP Board has therefore concluded the review of these assets.

– AMP continues to review options for maximising the ability to grow and invest in AMP Capital including exploring partnership options.

– The Board will provide an update on the outcome of ongoing discussions as soon as possible.

AMP strategy

– Strategic delivery momentum in FY 20 despite challenging environment.

– Strong progress in reshaping advice network to a more compliant, professional and productive cohort with practice exits delivered to plan in FY 20.

– Successfully completed renovation of AMP Bank’s core technology platform on time and under budget, increasing operational capacity for future growth and improving client service.

– Significant simplification of New Zealand wealth management, laying foundations for future growth.

– Growing asset management business through pivot to private markets; completed repurchase of MUTB’s 15 per cent stake in AMP Capital to support strategy pivot.

– Acceleration of culture transformation: comprehensive set of actions announced to drive an inclusive and high-performing culture.

– Delivered A$121 million of cumulative gross cost savings in FY 20; remain committed to deliver A$300 million annual run-rate savings (ex AMP Capital) by FY 22.

AMP Chief Executive Francesco De Ferrari said:

“2020 was a tough year across the world. COVID-19 unsettled our clients, our workplaces and the broader community.

“Volatility in markets and the economic downturn impacted the investments and financial security of many Australians and New Zealanders. True to our long-term purpose, AMP stepped up to support our clients navigate the uncertainty, providing early access to their super, pauses on their mortgage repayments, relief on their rent, and advice and guidance when needed.

“Within our business, it was also an extraordinary year, with significant internal change and the initiation of a portfolio review in 2H 20. The review has made good progress, assessing options for the group’s assets and businesses, and we are confident of bringing it to a conclusion in the near future.

“Amid all these events, I couldn’t be more proud of our teams who, working remotely, maintained a relentless focus on the execution of our strategic agenda. In 2020, we have laid the foundations of our transformation, delivering 90 per cent of our commitments to investors.

“Most notably, we completed the sale of AMP Life, unlocking capital and simplifying our portfolio. In AMP Australia, we simplified our super business, substantially progressed the reshape of advice and delivered a major platform upgrade in AMP Bank enabling future growth. We also pivoted AMP Capital, increasing focus on private markets, where the strength of our real assets franchise continues to deliver.

“We have maintained focus on costs, with an acceleration of efficiency initiatives in 2H 20, following increased investment in client support in the first half.

“Underpinning our strategy, we have also accelerated our cultural transformation and are determined to drive a culture of inclusion, accountability and high performance.”

Business unit results

AMP Australia

Australian wealth management

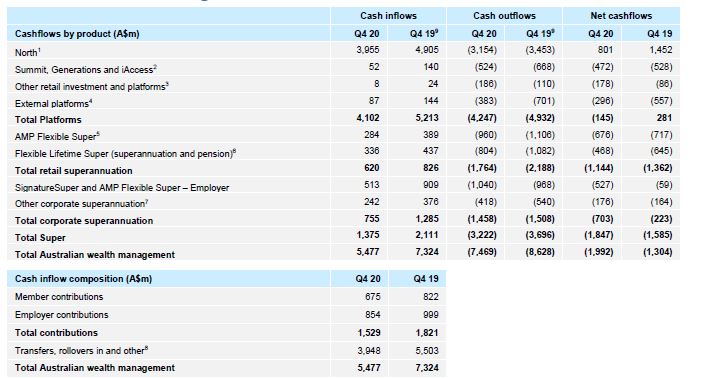

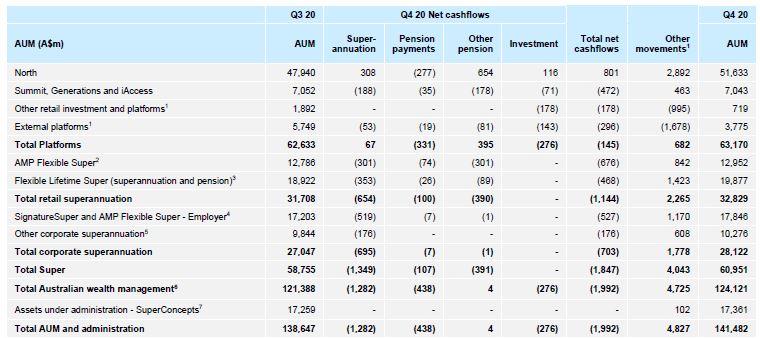

Australian wealth management navigated an unprecedented period of market volatility and industry disruption while increasing support for clients impacted by COVID-19. Assets under management (AUM) decreased 8 per cent to A$124.1 billion primarily due to net cash outflows.

Net cash outflows of A$8.3 billion in FY 20 includes A$1.8 billion in early release of super payments to support clients experiencing financial hardship during COVID-19, in addition to the previously announced exit of A$1.8 billion in corporate super mandates. Removing one-off impacts, underlying cashflows have improved on FY 19. Pension payments to clients in retirement were A$2.1 billion in FY 20.

AUM on North continued to grow, up from A$47.6 billion to A$51.6 billion in FY 20. North net cashflows of A$3.7 billion in FY 20, down 6 per cent on FY 19, reflects a slowdown in activity during COVID-19.

Net profit after tax of A$110 million (FY 19: A$195 million) reflects a decline in revenue predominantly from weaker investment markets and the impact of pricing and legislative changes.

AMP Bank

AMP Bank’s mortgage book was resilient despite the COVID-19 impact on borrowers and increasing residential mortgage competition. The residential mortgage book remained stable at A$20.2 billion in FY 20, with focus on maintaining credit quality.

Approximately 11 per cent of AMP Bank’s mortgage clients paused repayments during COVID-19. At FY 20, more than 80 per cent of these clients had resumed repayments or were in the process of restarting.

The bank’s credit loss provisioning increased by A$24 million (after tax) in 1H 20 predominantly reflecting expected economic impacts of COVID-19. Credit quality remains strong with 90+ days arrears at 0.62 per cent, which has improved from 0.66 per cent at FY 19.

Total deposits increased A$1.7 billion to A$16.1 billion, strengthening the bank’s deposit to loan ratio to 78 per cent, up from 70 per cent at FY 19.

Net profit after tax of A$119 million decreased A$22 million from FY 19, reflecting the increase in credit loss provisioning. Underlying this result, net interest income increased by A$4 million. Net interest margin declined 10 basis points to 1.59 per cent in FY 20 driven by higher funding and deposit costs.

AMP Capital

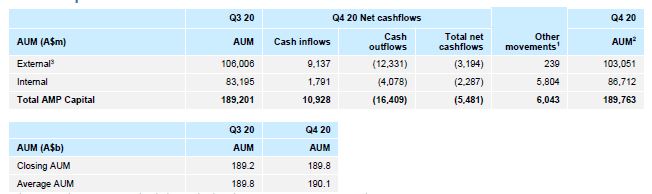

AMP Capital maintained momentum in real assets amid a challenging year in investment markets and significant internal change. Total AUM decreased to A$189.8 billion (FY 19: A$203.1 billion), driven by the economic impacts of COVID-19 on investment markets and an increase in internal cash outflows in Australian wealth management.

External net cash outflows were A$1.7 billion in FY 20 (FY 19: A$2.5 billion external net cashflows) due to an increase in public markets redemptions, partially offset by net cash inflows of A$2.7 billion from real assets (infrastructure and real estate) as committed capital was deployed. External cash outflows included the return of A$1.0 billion to investors as part of the life cycle of the AMP Capital Infrastructure Debt Fund series, with these funds delivering strong performance outcomes for clients.

Strong investor demand for AMP Capital’s real asset capabilities remains with A$4.1 billion committed capital available to deploy as at the end of FY 20.

FY 20 seed and sponsor capital investments were A$391 million, with the gain on investments declining compared to FY 19 due to lower valuations from underlying exposures including international airports.

Net profit after tax of A$139 million in FY 20 (FY 19: A$204 million) reflects lower income from performance and transaction fees, down A$33 million compared to FY 19, primarily due to market-related impacts of the pandemic. AUM-based earnings showed resilience in FY 20, delivering A$564 million of revenue compared to A$586 million in FY 19.

New Zealand wealth management

New Zealand wealth management showed continued stability during an unprecedented period for clients and businesses. AUM increased A$128 million to A$12.4 billion in FY 20 supported by an increase in KiwiSaver net cashflows, which were up 108 per cent to A$229 million. Total net cash outflows of A$57 million improved from FY 19 net cash outflows of A$433 million due to improved KiwiSaver performance.

FY 20 net profit after tax of A$36 million (FY 19: A$44 million) reflects a decline in revenue following the closure of two legacy products, and the COVID-related lockdown impacting the ability to generate advice-related income.

Client remediation

AMP’s client remediation program is 80 per cent complete at FY 20 in line with guidance. The program remains on track to complete in mid-2021.

Client remediation comprises the following components:

– Inappropriate advice: program approximately 97 per cent complete

– Fee for no service:

- Active advisers: program approximately 80 per cent complete

- Inactive advisers: program approximately 45 per cent complete

- Overall fee for no service expected refund rate of 19 per cent (28 per cent including interest) of total ongoing service fees charged.

Total program spend at FY 20, including program costs and money repaid to clients, is A$405 million. Payments to clients are expected to accelerate in 1H 21 as the program completes. Overall remediation costs remain broadly in line with original estimate provided in November 2018.

Capital position and dividend

AMP remains well-capitalised with surplus capital of A$521 million above target capital requirements as at 31 December 2020, down from A$529 million at 31 December 2019.

The completion of the AMP Life sale on 30 June 2020 enabled a fundamental reset of AMP’s capital framework, which released A$913 million of surplus capital. Allocation of surplus capital in FY 20 included:

– A$344 million paid to shareholders in the form of a 10 cents per share special dividend.

– A$418 million to repurchase MUTB’s 15 per cent stake in AMP Capital to enable the acceleration of AMP Capital’s growth strategy.

AMP anticipates the remaining capital surplus will fund the completion of the three-year transformation strategy.

To maintain balance sheet strength and prudent capital management during a period of transformation, the board has resolved not to declare a final dividend for FY 20. The board is committed to restarting the group’s capital management initiatives including the payment of dividends, share buyback and other capital initiatives in 2021. This is subject to the completion of the portfolio review, market conditions and business performance.

Update on strategy

AMP has completed the first full year of its three-year transformation strategy to become a simpler, client-led, growth-oriented business. Progress in FY 20 includes:

Simplify portfolio

– AMP Life: sale successfully completed on 30 June 2020, de-risking AMP and enabling a fundamental reset of our capital framework.

– New Zealand wealth management: following decision to retain, significant progress has been made to further simplify the business, laying the foundation for future growth. NZWM announced it will move to a predominantly index-based investment approach in 1H 21, providing a simpler and more cost-effective investment structure that aims to improve performance for clients.

Reinvent wealth management in Australia

– Reshape advice: practice exits delivered to plan in FY 20 with program now 75 per cent complete. During FY 20, approximately 85,000 advice clients were transitioned to new Annual Advice and Service Agreements.

– Build best-in-class retail super business: successfully delivered next phase of superannuation simplification program, reducing number of products from approximately 70 to 11.

– Grow successful platform business: continued to enhance functionality and products.

– Maintain growth momentum in AMP Bank: successfully completed the renovation of AMP Bank’s core technology platform on time and under budget, increasing business efficiency and operational capacity for future growth.

– Leadership: Scott Hartley was appointed as Chief Executive of AMP Australia to drive transformation of the business.

AMP Capital: grow successful asset management franchise

– Private markets: momentum maintained in real assets with A$2.8 billion of capital deployed in quality infrastructure assets on behalf of investors in FY 20. A further A$4.1 billion of uncalled committed capital is available to be deployed as at FY 20. Direct international institutional clients grew by 42 to 400 in FY 20, with AMP Capital managing A$22 billion on their behalf.

– Public markets: continued to explore partnership opportunities to maximise shareholder value. Delivered strong investment performance during period of extreme market volatility with 94 per cent of Global Equities and Fixed Income AUM outperforming benchmark over three years.

– Leadership: David Atkin announced as Deputy CEO, assuming operational leadership of AMP Capital in an interim capacity until June 2021.

Create a simpler, leaner business

– Reshape cost base: delivered A$121 million of cumulative gross cost savings in FY 20. Program on track to deliver A$300 million annual run-rate savings (ex AMP Capital) by the end of FY 22.

– Strengthen risk management, controls and governance: continued to deploy A$100 million (pre-tax) investment program to further strengthen risk management, internal controls and governance.

– Transform culture: AMP progressed several initiatives to accelerate its culture transformation during 2H 20, including:

- A Board Culture Working Group, chaired by AMP Chair Debra Hazelton to oversee and guide our program of work

- Established an employee Inclusion Taskforce, which has collaborated to develop a group-wide inclusion and diversity framework and 2021 inclusion plan

- Rolled out an inclusive leadership program with AMP’s Executive Committee and all senior leaders

- Reviewed workplace conduct, assessed against five best practice pillars, which will inform further actions to be launched this year.

More detailed information on the FY 20 result is available in the FY 20 investor report and presentation, both accessible at amp.com.au/shares.

Media teleconference

A conference call for media with Francesco De Ferrari (CEO) and James Georgeson (CFO) will be held at 9.15am (AEDT) today, 11 February 2021.

Dial in details:

Australia: Toll free 1800 220 860

New Zealand: Toll free 0800 453 540

Metered number for all other countries: +61 7 3107 6320

An analyst briefing starting at 12.30pm can be viewed via webcast at amp.com.au/webcasts.

1 Net profit after tax (underlying) represents shareholder attributable net profit or loss after tax excluding market adjustments, accounting mismatches and non-recurring revenue and expenses. NPAT (underlying) is AMP’s preferred measure of profitability as it best reflects the underlying performance of AMP’s business units.

2 AMP Capital is shown net of minority interests. AMP regained 100 per cent ownership of AMP Capital and MUTB’s minority interest consequently ceased on 1 September 2020.

Q4 20 Cashflows

Australian wealth management

1 North is an award-winning fully functioning wrap platform which includes guaranteed and non-guaranteed options. Includes North and MyNorth platforms.

2 Summit and Generations are owned and developed platforms. iAccess is ipac’s badge on Summit.

3 Other retail investment and platforms include Flexible Lifetime – Investments and AMP Personalised Portfolio. Flexible Lifetime – Investments no longer reported from November 2020.

4 External platforms comprise Asgard, Macquarie, BT Wrap platforms and Challenger annuities. Non-AMP administered external platform products no longer reported from November 2020.

5 AMP Flexible Super is a flexible all in one superannuation and retirement account for individual retail business.

6 Flexible Lifetime Super (superannuation and pension) was closed to new business from 1 July 2010. A small component of corporate superannuation schemes are included.

7 Other corporate superannuation comprises CustomSuper, SuperLeader and Business Super. Business Super was closed in May 2020 with members migrated to CustomSuper or AMP Flexible Super.

8 Transfers, rollovers in and other includes the transfer of accumulated member balances into AMP from both internal (e.g. retail superannuation to allocated pension/annuities) and external products.

9 Q4 19 inflows and outflows have been restated to reflect the treatment of insurance premiums to AMP life, no impact to total cashflow.

1 Other movements include fees, investment returns, distributions, taxes and foreign exchange movements. There is a one-off negative movement of A$3.1b in AUM for products no longer reported in AWM from November 2020 (A$2.0b in External platforms, A$1.1b in Other retail and investment platforms).

2 AMP Flexible Super includes A$0.9b in MySuper (Q3 20 A$0.8b).

3 Flexible Lifetime Super (superannuation and pension) includes A$5.3b in MySuper (Q3 20 A$4.9b).

4 SignatureSuper and AMP Flexible Super – Employer includes A$9.6b in MySuper (Q3 20 A$9.1b).

5 Other corporate superannuation includes A$5.3b in MySuper (Q3 20 A$4.9b).

6 At Q4 20, 77% of AUM is ultimately externally managed, while 23% is internally managed.

7 SuperConcepts assets under administration includes AMP SMSF, Multiport, Cavendish, SuperIQ, Moore Stephens Annual, JustSuper, Ascend and SuperConcepts platforms, but does not include Multiport Annual, SuperConcepts Accountants Outsource, SMSF Managers and MORE Superannuation.

AMP Capital

1 Other movements include fees, investment returns, distributions, taxes, and foreign exchange movements.

2 AUM is invested capital. Committed real asset capital is excluded from AUM.

3 Q4 20 includes A$3.0b of fixed interest net outflows, predominantly from the loss of a single mandate.

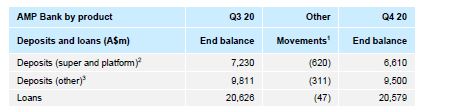

AMP Bank

1 Represents movements in AMP Bank’s deposits and loan books.

2 At 31 Dec 2020, Super and Platform deposits include AMP Supercash and Super Term Deposits (A$2.4b), North and platform deposits (A$4.2b).

3 Deposits (other) includes retail deposits, internal deposits, wholesale deposits and other deposits.

New Zealand wealth management

1 Other includes superannuation, retail investment platform and legacy products.

2 Other movements include fees, investment returns, distributions, taxes, as well as foreign currency movements on New Zealand AUM.