- Most under 40s haven’t spoken to their parents about wealth transferral

- Under 40s not relying on ‘bank of mum and dad’, despite housing unaffordability fears

- Half of under 40s expect to financially support their parents as they age

Insights revealed from the second phase of AMP’s research uncovering Australians’ attitudes to intergenerational wealth show a clear desire of under 40s to secure their own financial independence.

Under 40s are not relying on the ‘bank of mum and dad’ despite concerns that increasing housing unaffordability will impact their own wealth in retirement and the growing wealth divide between generations as property values appreciate.

Further, the research reveals that half of those under 40 believe they will need to support their parent financially as they age, with children and their parents reluctant to discuss intergenerational wealth matters.

Key findings include:

- Half of those under the age of 40 expect to financially support their parents as they age

- Only 1 in 5 are relying on financial assistance and inheritance from their parents for their future financial security

- 4 in 5 under 40 haven’t asked their parents for any financial support

- 3 in 5 under 40 haven’t spoken to their parents about wealth transferral

- 3 in 5 under 40 believe their generation has it harder financially than their parents did, increasing to 7 in 10 for those under 29

- 4 in 5 under 40 who currently don’t own a property believe it will be out of reach

- 4 in 5 under 40 believe that not owning a property will be detrimental to their long-term wealth in retirement

- 8 in 10 under 40 would consider purchasing a property with a friend or a family member, 4 in 5 for those under 29

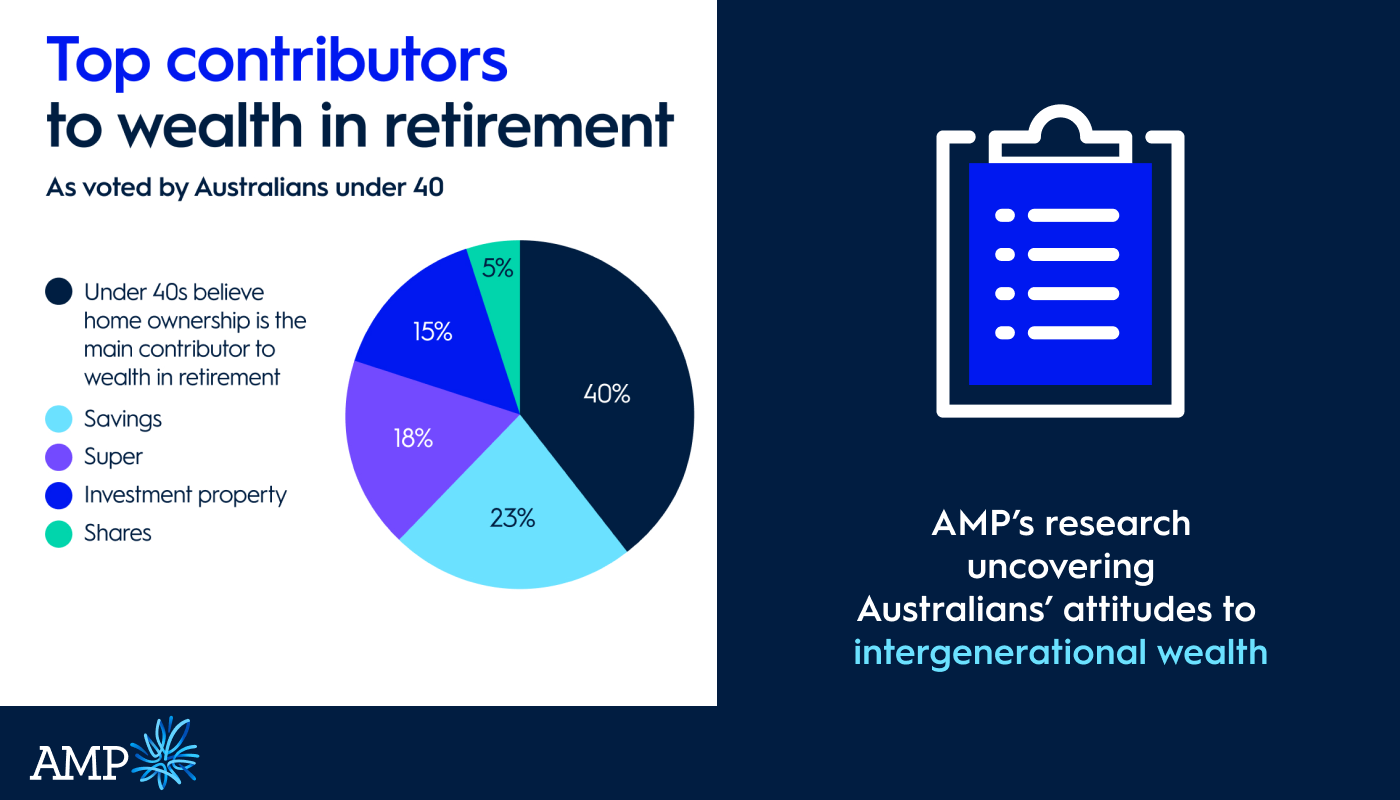

- Under 40s believe home ownership is the main contributor to wealth in retirement (40%), followed by savings (23%) followed by super (18%), followed by investment property (15%), followed by shares (5%)

The findings follow the first phase of AMP’s intergenerational wealth research which shows that retirees want to support their children, but are also concerned about their own financial security and lifestyle.

An estimated $3.5 trillion is set to be transferred by Australians aged 60+ in the next two decades, with 90% of all intergenerational wealth transferral occurring through death inheritance1

We also know that most Australians find our retirement system complex2, likely contributing to retirees underspending in retirement, with the Intergenerational Report finding that many draw down at the legislated minimum on their super balance3

AMP Director of Retirement, Ben Hillier said:

“This latest research reveals an interesting dynamic within families, including a lack of communication between the generations on wealth matters.

“It’s also evident that while many Australians under 40 are concerned about housing unaffordability and its impact on their long-term wealth and retirement, they are reluctant to ask for financial support from their parents, with many actually believing they will need to financially support their parents as they age.

“It’s worth considering these findings with the knowledge that many Australian retirees are fearful their savings won’t last – a fear which prevents spending and impacts their quality of life. It’s also very possible these concerns are inadvertently conveyed to their children and hinder open dialogue on wealth matters.

“We have a significant opportunity in Australia to help more retirees build their financial confidence, empowering them to fully enjoy their post-working years. This can be achieved through better access to lifetime income solutions and financial advice, improved financial literacy at all ages, and a simplified retirement system.

“Most importantly this confidence could improve their quality of life in retirement, but it could also be a catalyst to open the lines of communication with their children on important wealth matters, such as inheritance and estate planning. It may even empower them to support their children financially, which we know from AMP’s previous research they’re keen to do.

“Importantly, the sharing of knowledge and insights could help build greater collective financial literacy and confidence within the family unit.”

AMP Bank Group Executive, Sean O’Malley said:

“It’s also clear from the research that under 40s are concerned housing unaffordability will impact their long-term wealth – a justifiable concern given home ownership is one of the key pillars for wealth in retirement for most Australians.

“Building the financial confidence of retirees and finding better ways to unlock home equity would also empower more older Australians to support their kids.

“While this needs to be tackled at a macro level by federal and state governments, there are other, more immediate options for younger Australians wishing to purchase their first property. For example, AMP’s research has indicated a strong willingness of younger Australians to consider joint property ownership with family and friends.

“Fractional lenders, such as Bricklet, specialise in offering this service, and can provide an alternative and lower risk means of joining the property ladder.

“We would encourage younger Australians to talk to their bank or broker about the different lending options available to them.”

Other findings from the research include:

- 2 in 5 Australians aged 50 to 58 indicated they don’t have a will in place.

- 9 in 10 Australians under 40 believe owning a property is important for building wealth.

- Of those under 40 who don’t own a property:

o 4 in 5 are concerned home ownership will out of reach

o 4 in 5 are concerned with will impact their long term wealth

- Only half of Australians under 40 believe they can afford to buy a property in the same areas where their parents live and where they grew up

- 4 in 5 under 40 would or have relocated to buy their first home

- More than 2 in 5 under 40 believe their parents’ property is too large or doesn’t meet their current needs

- 7 in 10 under 40 want to live in the property they buy

About the research

AMP commissioned Dynata in February 2024 to conduct a survey of 2000 Australians aged 50 years and over and under 40 years in relation to their attitudes to retirement and intergenerational wealth transferral.

[1] Wealth transfers and their economic effects. Australian Government Productivity Commission, 7 December 2021.

[1] AMP commissioned research, released September 2023.

[1] Intergenerational Report 2023, Australia’s Future to 2063, 24 August 2023